The State of Subscription Commerce 2021

What can the subscription ecommerce industry learn from 2020? We break down how top brands pivoted to meet their customers’ changing needs.

2020 was a banner year for physical subscription commerce.

In this year’s annual report, we analyze the ways in which the subscription industry transformed between 2019 and 2020, breaking down our findings into key takeaways you can apply to your future business strategy.

Explosive growth

In 2020, the physical subscription ecommerce market shifted in monumental ways. More subscription stores joined the market than ever before, and subscribers grew over 90% year-over-year. With this meteoric rise in mind, what challenges and opportunities are on the horizon for each vertical, and overall in the industry?

More spent, more gained

While new subscribers joined the market at unprecedented rates, they were also spending more, increasing AOV for subscription merchants. As investments in subscription products rose, brands pivoted with flexible product offerings that were more effectively able to meet customers where they were: at home.

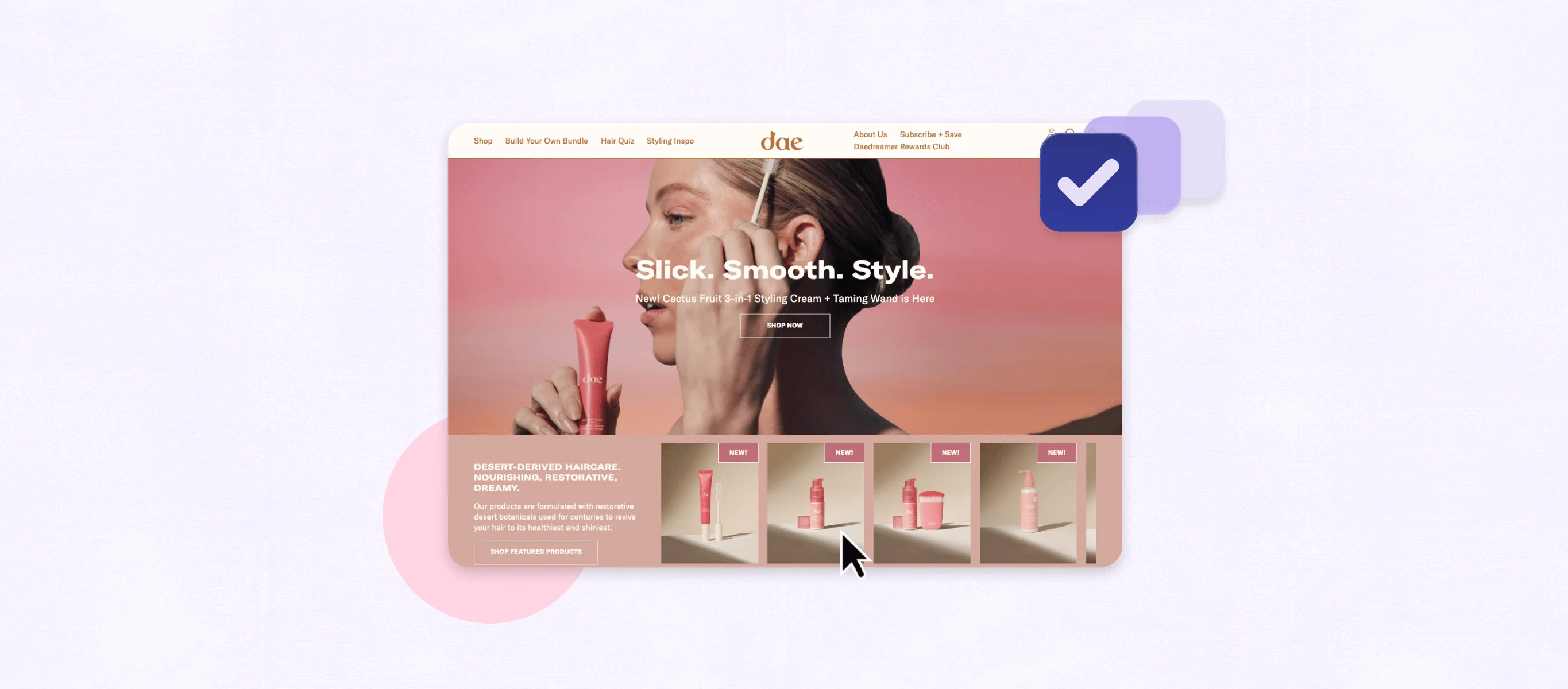

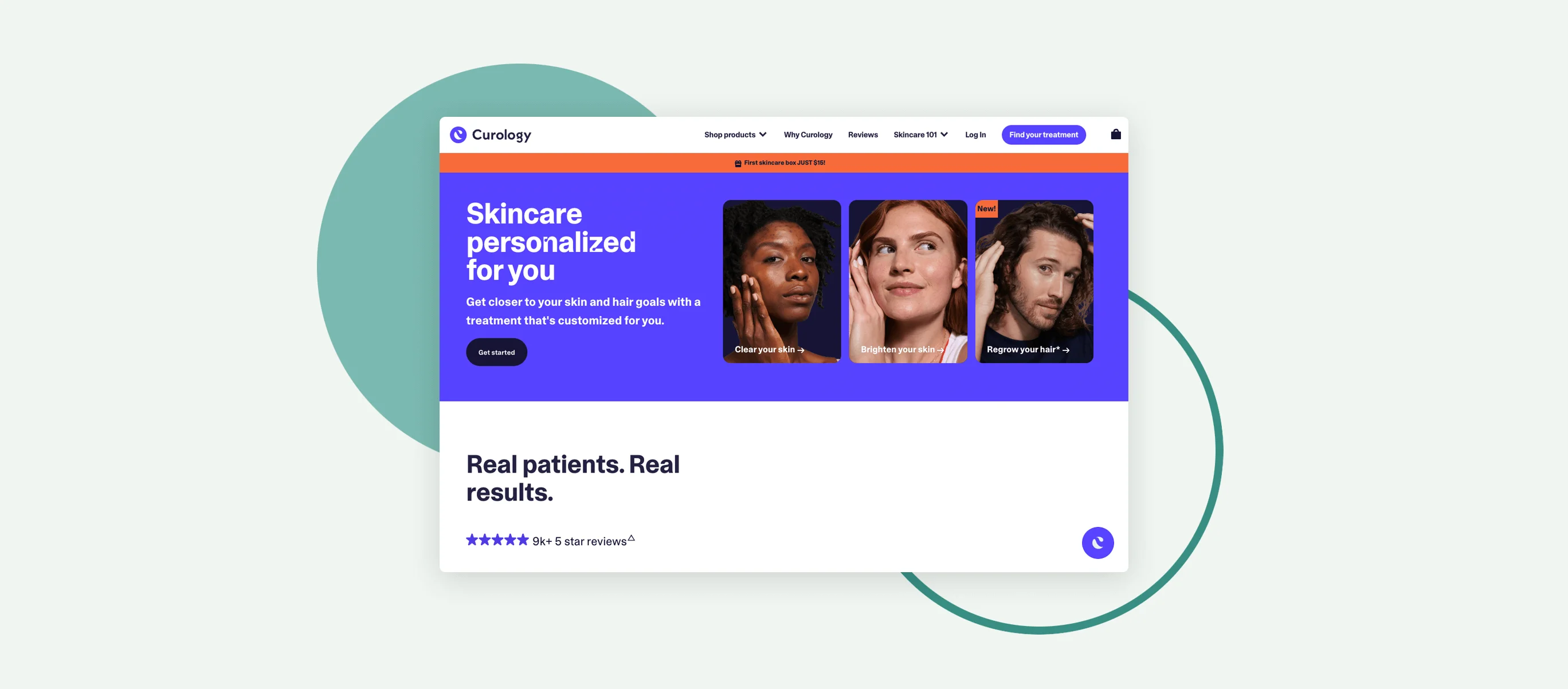

Best-in-class merchants

By deploying strategies to better meet customer needs, top-tier brands maintained higher levels of AOV, customer LTV, subscriber counts, and MRR. We dig into the strategies these merchants used to achieve new levels of success, along with action items and considerations your brand can use to grow and scale your business.

Looking to gain insights into the changes 2020 brought to subscription ecommerce?

Here's a glimpse into what you'll find:

Over a 12 month period, we analyzed data from 9,000 merchants serving 20 million subscribers, totaling nearly $3 billion in orders

From 2019 to 2020, many traditionally brick-and-mortar stores shifted to meet their customers where they were with ecommerce offerings

Across verticals, AOV for merchants increased an average of 6%

Frequently asked questions

What is subscription commerce?

The subscription commerce business model involves the buying and selling of goods and services on a recurring schedule. Subscription commerce businesses can include everything from SaaS companies to gated memberships to streaming services to companies who sell and deliver physical boxes of products.

What is physical subscription commerce?

In The State of Subscription Commerce 2021, we focus on merchants who sell physical subscriptions, meaning their subscribers receive something tangible. Physical subscriptions can include everything from boxes of curated novelty items to meal kits to frequently-used household items and everything in between.

What verticals does the report discuss?

In this report, we discuss seven key verticals: Food & Beverage, Health & Wellness, Beauty & Personal Care, Fashion & Apparel, Home Goods, Pets & Animals, and Other (made up of a variety of items, like curated boxes of hobby items).

How does the report define top-tier merchants?

The report defines top-tier merchants as the top-performing third of merchants studied by GMV (gross merchandising volume).

You might also like...

How to reach your next subscriber milestone

Katrina Nguyen August 1, 2024 Aug 1, 2024

First-party data vs. zero-party data for customer retention: Definitions & examples

Erin Chesterton July 26, 2024 Jul 26, 2024